Canaccord Genuity & RF Capital Group: A Tale of Two Cities

UPDATED: A Brief Overview

UPDATED

The most contentious rivalry seen on Bay Street since the heydays of the independents in the 80s, and the chapter seems to be coming to a close with one last bout - a hostile takeover.

Canaccord Genuity and RF Capital Group (better known as Richardson Wealth, Richardson GMP, or GMP) have been duking it out on Bay St. for what seems like the better half of two decades. A feud that has become integral to their identities and has shaped the idea of what the modern Canadian independent looks like. Preeminence, legacy, and ego.

It came as no surprise that the feud would inevitably turn hostile as news broke on March 15, 2021 that Dan Daviau, CEO of Canaccord Genuity, has spent the past several months knocking on the door of Hartley Richardson, Patriarch to the Richardson family, with a takeover bid of RF Capital Group - the parent company of Richardson Wealth. Following six months of radio silence from Richardson, Daviau has decided to go hostile, publicly announcing his firm’s intentions to acquire 50%+ of RF Capital’s shares outstanding. The first major hostile takeover in Canada in recent memory. But how did we get here?

Let’s rewind the clock.

It’s 2016, Canada’s prolonged commodities super-cycle has busted, and Canaccord Genuity’s stock price has hit rock bottom. Less than a year into his tenure, newly appointed CEO, Dan Daviau, is struggling to keep the ship afloat. Daviau had taken the reins of Canaccord Genuity after former CEO Paul Reynolds suddenly died from a tragic heart attack. Reynolds succeeded founder Peter Brown, and was the second CEO in Canaccord’s history. Now, tragedy and discord plagued the firm.

Amidst the cyclical downturn across mining and energy (industries Canaccord and the likes relied heavily on for banking revenues) a wave of key bankers began departing, and the company was hurting. Canaccord remained well capitalized, but it was clear that Daviau and his team would have to institute some big changes if the firm wished to secure any chance of remaining competitive.

Meanwhile, down the street, Harris Fricker, CEO of GMP Capital, was busy buying the dip. Fricker levered up GMP and dished out C$98M to buy FirstEnergy Capital Corp., an energy-focused advisory and investment services firm based in Calgary.

At the same time, GMP’s wealth management arm, Richardson GMP, was on the block with bids from TD and Raymond James. Richardson GMP was expected to fetch a TEV of ~C$600M, which would have spelt a nice payday for GMP Capital, who owned 1/3rd of the money manager along with the Richardson family and Richardson GMP’s advisors.

With both firms weathering the cyclical downturn, things certainly looked rosier at the offices of GMP. By year end, however, the tide would turn and the cannabis bull market would change the street dynamics.

GMP Securities, GMP Capital’s investment banking business was suffering. Cannabis revenue was keeping the lights on, but complicated staff rationalizations/lay-offs had to be made in order to integrate FirstEnergy. To throw salt on the wound, GMP’s ~C$200M payday from the sale of Richardson GMP failed to materialize. On April 2017 Richardson GMP would announce that the business is not for sale, and the firm would remain independent. A bold move on Richardson’s part, but a decision that would only create more problems.

As the cannabis frenzy developed, Canaccord Genuity began gaining market share from GMP and acquiring top talent. At the GMP offices, tensions rose between the investment dealer and the wealth management arm - compounded by the overhang created from Richardson GMP’s no-sale. Three years later, in 2019, GMP Capital sold its investment banking division to Missouri-based Stifel Financial. Following the successful sale of GMP Securities to Stifel, Richardson GMP amalgamated its shares and rolled into GMP Capital, rebranding under the Richardson banner to RF Capital Group - albeit, no easy task as activists Anson Funds and GMP founder Kevin Sullivan rocked the boat along the way.

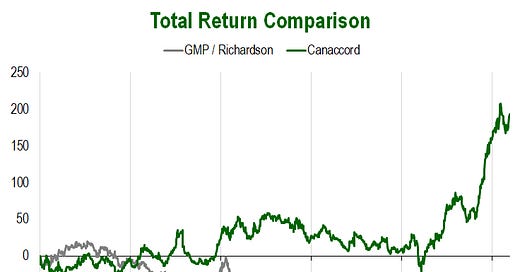

Throughout that same three year period, Canaccord Genuity stabilized, grew its investment banking business, and invested heavily into its wealth management arm, garnering support from Morgan Stanley along the way. The company’s new issue business began making headways, trumping its independent peers and competing with the likes of the big banks. In 2019, Canaccord Genuity acquired Australian-based wealth management firm Patersons, a move placing the firms global AUA at $88B. In early 2021, Canaccord Genuity received a ~$200M investment from a third-party into the firm’s UK wealth management business.

Over the past five months, Richardson Wealth has emerged from its corporate restructuring in hopes of shaking its volatile past. Management announced several strategic alliances with leading independent dealers Cormark Securities and Bloom Burton, long-time CEO, Andrew Marsh stepped down, and things seem to be heading in the right direction.

But Daviau isn’t done.

With the recent emergence of Richardson Wealth as a new entity, and Canaccord Genuity trading at all time highs, the long-time rivalry has only intensified - but now with a clear dominant party.

As it stands, Canaccord Genuity has gone public with its hostile takeover bid of RF Capital Group at $2.30/sh. The Richardson family currently holds ~44% of the shares outstanding, and are adamant that the business is not for sale. With Daviau motivated to buy, Canaccord Genuity has a finite amount of time to convince 51% of shareholders to tender. So where do things currently stand?

The Richardson family owns 43.7% of shares outstanding, as outlined from RF Capital through the company’s amalgamation disclosures, the remaining shares are controlled by former and current management, bringing total stagnant shares to ~49.5%. For good measure, let’s subtract the 944K shares owned by Gene McBurney, as he recently joined Canaccord so we know where his vote lies. That brings stagnant shares down to 48.9%.

IAs and GMP minority shareholders control a combined 56.2% - less whatever shares are unlocked at their set release dates in increments of 10%.

Adding salt to the wound, Canaccord Genuity determined the purchase price using RF Capital’s fairness opinion provided for the share amalgamation, valuing RF at $2.00-$2.55/sh.

The downside is limited for the folks at Canaccord Genuity - while the upside is a successful wealth management business or a fragile boat being rocked further with distraction.

Only time will tell.

Cheers,

G.G.

Thank you