November 27, 2024

Subs -

WE ARE LIVE.

Qualified Canadian Readers Only.

Tides are shifting, and there’s no shortage of strong headlines this week in Canada.

Let’s start with the big one. On Monday, CI Financial announced that it was going private in a landmark $12.1B all-cash acquisition by Abu Dhabi-based Mubadala Capital. At $32.00/sh., the offer price implies a premium of ~33% to the pre-announcement closing price. This marks a stunning end to a tumultuous (but ultimately successful) share price run over the last few years, and the beginnings of a new era in Canadian wealth management independence.

At ~$482B in AUA (assets under administration), the deal represents a ~2.5% multiple of AUA. Recall, the median EV/AUM for Canadian asset managers is 1.6%, and the median Price/AUA for Asset and Wealth Management transactions in Canada is 2.2%. Talk about buying at the top – this transaction is a clear expression of the lengths Mubadala is willing to go to pay for growth and a strong bet on CI’s strategy.

But enough about wealth management, let’s talk about the real winners in this deal: the bankers. INFOR Financial acted as exclusive financial advisor to CI’s special committee – which is the last name I expected to see in the press release (I say that as a compliment). No doubt there were some concessions made to win the mandate, as INFOR was paid a non-success, fixed fee. However, it gladdens me to see that meaningful, important business can still be won by the independents. In this industry, you only make your mark by punching above your weight.

Like every local politician, I’m a big supporter of community-oriented, grassroots, small businesses; and there’s always a special place in my heart for the mom-and-pop shops of Bay Street. I will be keeping my ear to the ground for closing dinner details. If the INFOR team is reading this, feel free to save me a seat. Alternatively, I will look out for my invite to their hit podcast, Stocks Not Sports hosted by their Head of Sales, Kenrick Sylvestre - which I will happily plug.

Off the back of CI’s headline transaction, news “leaked” that Canaccord Genuity is exploring a sale of its UK Wealth Management business. The rumours were quickly put to bed by Canaccord Genuity’s PR team, shortly after the headline hit Bloomberg. Recall, Canaccord Genuity is still within its standstill period until Q1’2025 from its failed management buyout attempt. Oddly enough, Canaccord Genuity provided a comment to the press regarding the strategic review. The stock was up +1.5% on the day.

Last Friday, crème de la crème real estate asset manager KingSett announced the gating of its $4.9B flagship real estate fund. Remarkably, I first heard of this from the Globe and not executive chairman Jon Love’s LinkedIn page. The move comes with mixed surprise. On one hand, the writing was on the wall. Funds managed by Romspen, Hazelview, and Four Quadrant have all had to halt their distributions in some capacity, amidst challenging property resale and financing markets in Canada. On the other hand, it’s surprising to see a manger held in such elite regard stumble at this hour. To add salt to the wound, KingSett Mortgage has accused Metro Vancouver developer Thind Properties of misappropriating over $300 million.

Management was quoted saying “Our buildings are full, and our tenants are paying rent [...] but it has been difficult to sell properties to raise money with interest rates still elevated and economic growth weak.”

Here is Gary’s Real Estate Investing 101 Lesson of The Week:

Rent paying tenants ≠ free cash flow available to paydown debt

The need to sell properties to raise money (cash from investing activities) = not enough free cash flow from operating and investing activities to paydown debt

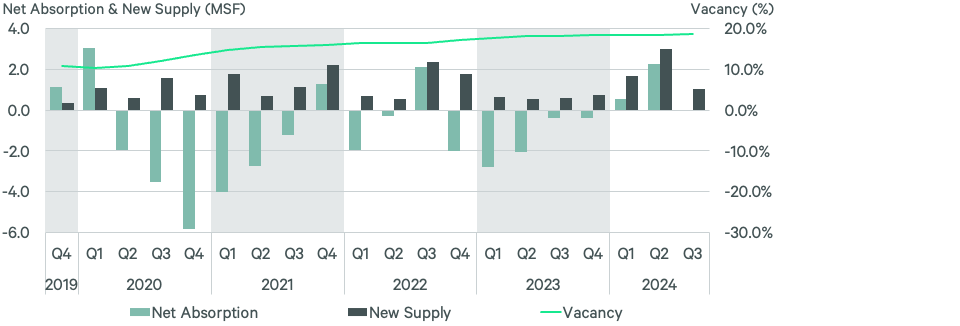

Now for some fun Canadian office real estate charts thanks to CBRE…

Canadian Office Supply & Demand

National Downtown Vacancy

National Office Inventory Under Construction

National Office Construction Starts

In more INFOR adjacent news, long-time INFOR client, Dye & Durham CEO, Matthew Proud, announced he will be stepping down from his CEO role effective the earlier of 3-months or when a successor is found. *Queue Succession theme song* If Mr. Proud was ever doubtful whether the markets liked him as CEO, he can be comforted in the fact that the stock rallied +11.5% on the news. The equivalent of the office cheering as you submit your resignation letter.

In ECM news, more risk capital is being put to work this week in the resource and energy sectors. Since November 20th, we have seen 5 new bought deal issuances (Topaz, Logan, Enterprise, Endeavour, Minera Alamos) come to market, all being common share deals.

The largest issuer, Topaz Energy, announced on Monday a $242MM after-market bought secondary offering of common shares with Tourmaline Oil. The deal was ~3x oversubscribed on the back of strong institutional demand and, on Tuesday morning, the deal was upsized to $300MM. Peters & Co. stick-handled this deal with BMO, with plenty of wide participation from the rest of the street (NBF, Scotia, RBC, CIBC, TD, Desjardins, Tudor). Interestingly, BofA, Jefferies, and UBS passed on their syndicate positions (each @ 1.0%).

Jefferies is said to have passed on every single syndicate position offered to them in Canada since reopening their maple franchise. The U.S. boutique dealer is rumoured to be leading the Apotex IPO in 2025 - which would mark their first (big) splash into the Canadian equity capital markets world.

ECM World

Top 5 Notable Transactions

Topaz Energy

$300MM secondary bought deal of common shares (Tourmaline Oil)

Peters w/ BMO

Logan Energy

$35MM bought deal of common shares

NBF w/ 8Cap

Enterprise Group

$20MM bought deal of common shares

CG w/ RJ

Condor Energies

$15MM marketed LIFE offering of common shares

RCC w/ Auctus, CG

Endeavour Silver

US$7MM bought deal of common shares

BMO w/ CIBC, TD, Ventum, HCW

Strongly,

G.G.